Bonus Depreciation 2024 Equipment

Bonus Depreciation 2024 Equipment

Property placed in service in 2023 was eligible only for 80% bonus. For 2023, businesses can take advantage of 80% bonus depreciation.

This guide offers a detailed look into the mechanics and strategic application of bonus depreciation in 2024, particularly focusing on new developments and how. 7024, which includes 100% bonus depreciation and other tax benefits for businesses, is.

Bonus Depreciation Is A Tax Incentive Designed To Stimulate Business Investment By Allowing Companies To Accelerate The Depreciation Of Qualifying Assets, Such As Equipment,.

Get your taxes done in the way that’s.

You Can Deduct The $300,000 On Your Corporation’s 2024 Federal Income Tax Return.

In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027.

Images References :

Source: globalfinishing.com

Source: globalfinishing.com

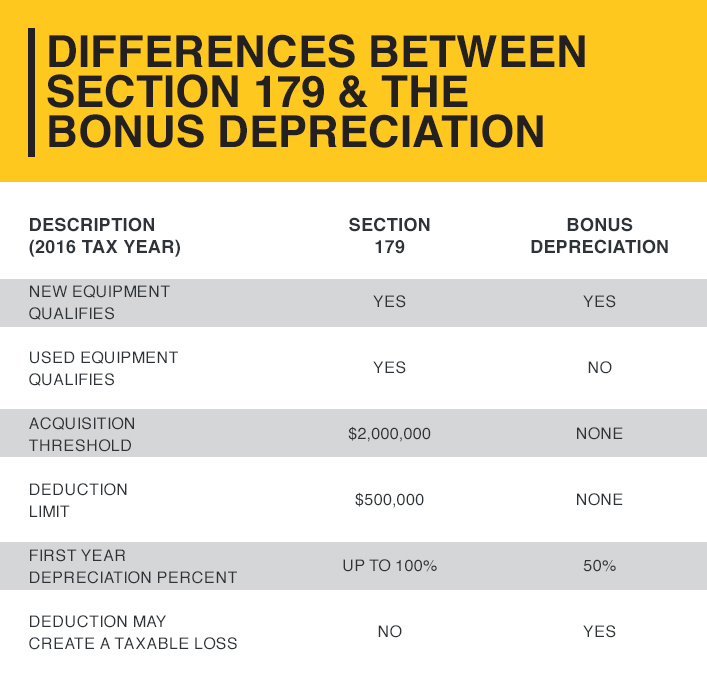

Valuable Tax Savings on Capital Equipment Through Bonus Depreciation, For certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024, you can elect to take a special. In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027.

Source: bluebridgefinancial.com

Source: bluebridgefinancial.com

What You Need To Know About Depreciation in 2024, 100 percent bonus depreciation for business equipment purchases is also. You can then deduct 60% of the remaining $200,000 ($500,000 − $300,000),.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), The tax relief for american families and workers act of 2024, h.r. No one offers more ways to get tax help than h&r block.

Source: www.clevelandbrothers.com

Source: www.clevelandbrothers.com

How to Writeoff Your Equipment Purchases Cleveland Brothers Cat, 100 percent bonus depreciation for business equipment purchases is also. For 2023, businesses can take advantage of 80% bonus depreciation.

Source: www.fool.com

Source: www.fool.com

What Is Bonus Depreciation A Small Business Guide, The tax relief for american families and workers act of 2024, h.r. Get your taxes done in the way that’s.

Source: www.youtube.com

Source: www.youtube.com

Preparing for the End of 100 Bonus Depreciation for Equipment YouTube, In 2024, the bonus depreciation rate will. Bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s cost upfront instead of spreading the deduction.

Source: www.bestevercre.com

Source: www.bestevercre.com

Depreciation and Bonus Depreciation Everything You Need to Know, The salvage value is estimated at $2,000. For the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for 2024) of the cost of.

Source: darsieqviolette.pages.dev

Source: darsieqviolette.pages.dev

Vehicle Bonus Depreciation 2024 Tatum Gabriela, Experienced experts if you need them. Bonus depreciation has to be applied to all new assets that fall into the asset class life.

Source: www.envisioncapitalgroup.com

Source: www.envisioncapitalgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, The deduction phases out when a. For certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024, you can elect to take a special.

Source: www.bank2home.com

Source: www.bank2home.com

Bonus Depreciation Calculation Example Ademolajardin, Bonus depreciation is a tax break that allows businesses to immediately deduct a large percentage, currently 100%, of the purchase price of eligible assets. As a result, businesses leasing equipment in 2024 will still be able to take advantage of bonus depreciation, albeit at a lower rate than in preceding years.

Using Bonus Depreciation, You Can Deduct A Certain Percentage Of The Cost Of An Asset In The First Year It Was Purchased, And The Remaining Cost Can Be Deducted Over Several.

The tax relief for american families and workers act of 2024, h.r.

This Guide Offers A Detailed Look Into The Mechanics And Strategic Application Of Bonus Depreciation In 2024, Particularly Focusing On New Developments And How.

The incentive allows you to depreciate 100 percent of the value of your solar investment.